R&D Consortia: Cooperating competitors

Contrary to what a naïve understanding of an introductory Economics course would teach you, markets have lots of cooperation in them, not only competition.

One example I want to discuss today is R&D Consortia: Different entities (Corporations, universities, and laboratories) coming together to do research, even when the individual members each have their own goals and products in mind

Why would different actors do this? The motivations include sharing costs and risks, exploring new concepts, pooling scarce talent, sharing research or manufacturing facilities, setting standards, sharing pre-competitive research results, accelerate technological development, big science and large projects, and facilitating technology transfer (Gibson & Rogers 1994).

As with many of my posts on innovation, this one resulted from a paragraph in Mazzucato's The Entrepreneurial State:

Recognizing the unique opportunity that semiconductor manufacturing would provide, and fearful of the consequences of lagging behind newly emerging competitors in semiconductor manufacturing such as Japan, the federal government gathered competitive domestic manufacturers and universities together to form a new partnership, the Semiconductor Manufacturing Technology (SEMATECH) consortium.

This move, to advance US-based semiconductor manufacturing technology and capability above and beyond that of the nation’s competitors, was part of an overall effort to promote US economic and technological competitiveness globally. The process of organizing collaborative effort between semiconductor companies through SEMATECH was a challenge for the government. In order to make this partnership more appealing, the US government subsidized SEMATECH R&D with $100 million annually. Over time, the members of the consortium came to recognize the benefits of the R&D partnership fostered by SEMATECH. The extensive knowledge sharing efforts that took place among members of SEMATECH helped them avoid duplicating research efforts and translated into less R&D spending.

Cooperation in the Semiconductor Industry

But as we can read in Gibson & Rogers (1994) the industry itself was already launching its own consortia as early as 1982, the Microelectronics and Computer Technology Corporation (MCC). By 1993, the MCC was made up of 100 companies, including 18 small businesses and 12 universities, and employed 340 researchers. During its first decade, it spent 500$ million of its members' funds, was granted 117 patents, licensed 182 technologies to universities and corporations, and published more than 2400 technical reports.

Surprisingly, some people considered the rise of consortias as negative, as it went against 'faith in competition'. Alliances and mergers should be prohibited, said famous management expert Michael Porter.

The origin of MCC lies in the decision of the CEO, William C. Norris, of a long defunct company, Control Data Corporation (CDC), to bring together executives from leading players in the US semiconductor industry to make a joint effort against Japanese competitors, setting a plan for a decade-long industry effort.

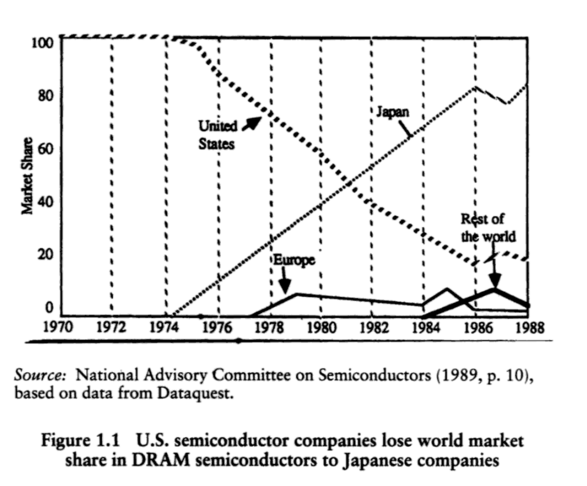

Back in the 80's, the US was in the curious situation of having 'invented' color TV, the microwave, the videocasette recorder, and semiconductors, but having lost market share to the Japanese at a constant rate,

According to the source previously cited, already in 1981 there was talk of making a joint industrial effort. They saw R&D consortia as key to Japan's technological success, and so wanted to imitate them. Norris attempted to organise one such consortia in the late 70s, without success. That changed when the Japanese government launched the Fifth-Generation Computer Project. According to Norris, he had been working on the consortium before Japan became a threat, but it was the threat itself that triggered the immediate formation of the consortium. Altough doing something like that may have been considered by some a violation of antitrust laws, the US government, because it considered semiconductors a national priority, didn't said anything about the MCC.

Firms joined MCC out of fear of Japanese competition, , because of the perception that there was excessive inter-firm competition, and insufficient inter-firm cooperation, and because they wanted to carry out long term research that was hard to justify if done separately. There were two tiers of firms: members, who contributed in full and were able to access to proprietary technology, and associates, small companies that payed less fees, but had less access.

Research consortia were not something new: the US copied the idea from Japan, and Japan copied the idea from England, where you could find consortia already in 1917. And perhaps, England got it from Sweden's Jernkontoret. Japan would repeat the copy-and-make-better feat when many companies adopted the Total Quality Management philosophy, originally developed by W. E. Deming, an american)

So the Japanese Ministry of International Trade and Industry (MITI) pushed the idea forward, providing tax breaks, pressing the companies into forming consortia, and crucially, by explicitly making such alliances legal. Explicit legality in the US would have to wait intil 1984, which was one of the reasons why consortia took so long to take off in the US.

Consortia are sometimes funded by governments, to varying degrees. In Europe, Japan and the US, government funding of consortia over total consortia funding was at 50%, 50% and 0.25%, respectively (In 1990). (Edit: The figure for the US doesn't look right, find source and review)

Japan's attempts at consortiamaking were initially failures, but over time companies learned how to cooperate together, which spawned a series of projects:

- Very Large Scale Integration (VLSI, 1976-1979), to catch up with IBM and other US manufacturers. Funded at $312 million, with half coming from the government, and building on previous research done at the national NTT Labs. VLSI grew out of talks held by the Japan Electronic Industry Development Association (JEIDA, 1958), who were struggling to compete with IBM and other US producers. A professor from the University of Tokyo, Shoji Tanaka suggested a collaboration, and, altough fraught with many problems, the project was finally launched. This was the first succesful MITI-sponsored consortium to be successful, after about 40 failures. The source cited attributes this to the amount of funding, the fact that there was an actual lab instead of having a program dispersed around many, and that the timing was right, as X-ray and electron beam litographic techniques had advanced enough to be of use to the industry.

- The Institute for New Generation Computer (ICOT, 1982-1992), formed by MITI, and funded at $1.35 billion, with 30% provided by the government. They advanced computer architectures, hardware, and software for AI. This was the project that led to MCC in the US.

- The Realtime Operating Nucleus (TRON, 1984), formed by 142 members, they did a veriety of research without government involvement.

- The Synchrotron Orbital Radiation Technology Center (SORTEC, 1986-1996), with 14 members, for doing research on synchrotrons, which are required for producing high density semiconductors. Their budget was $12 million per year, with 30% japanese funding. This wasn't the first synchrotron to be built in Japan, nor in the world. See Suller 1994.

- Optoelectronics Technology Research Corporation (OTRC, 1986-1996), a ten-year project to develop manufacturing techniques for optoelectronic materials. With a budget of $77 million, 70% was paid for by a MITI agency.

- The International Superconductiity Technology Center (ISTEC, 1988), with over 100 members, including companies from the US and UK. Funded with $17 million per year, with 33% coming from the government.

In Europe, the situation was different, and consortia appeared later:

- The European Strategic Programme or R&D in Information Technology (ESPRIT I, 1984), funded with $2 billion for 10 years. It includes more than 400 members, and doing a variety of research, with a focus on intra-European competition. There was a subsequent ESPRIT II (1987-1991) with $4.2 billion and ESPRIT III (1990-1994) with $3.7 billion, with 50% of all funding coming from the European Comission.

- The Alvey Project (1983-1987), funded by the British government with $360 million to improve Britain's semiconuctor manufacturing. It counted among its members 50 companies and 41 universities.

- Research and Development in Advanced Communications (RACEI, 1985), wth 90 members, and funded at $1.6 billion, with less than 50% coming from government. They did research on HDTV, mobile telecommunications, and communciations for manufacturing. A RACE II began in 1992, focused on more practical problems.

- European Research Cooperation Agency (EUREKA, 1985), with more than 370 members and a budget of $8 million (about 30% from government), conducted research in semiconductors, automotive technology, and HDTV.

- Basic Research for Industrial Technology in Europe (BRITE, 1985) and European Research in Advanced Materials (AURAM, 1986), with 490 members, and a budget of $1.3 billion (50% from government). They did research on superconductors, CAM, mathematical modeling of industrial processes, aeronautics, and advanced materials.

- Chip 1995, funded by the German and French governmetns to develop a 64 bit DRAM chip

- Mega-Project (1984), a five year consortium of Siemens and Phillips, wth a budget of $2 billion (7.5% from government), targeted toward developing advanced memory chips using European manufacturing equipment.

- JESSI (1989), a consortium of European semiconductor manufacturers, with a budget of $4 billion over eight years (25% government funded). JESSI did not allow IBM to become a a member until SEMATECH allowed European companies to participate in it, which happened thirteen years later.

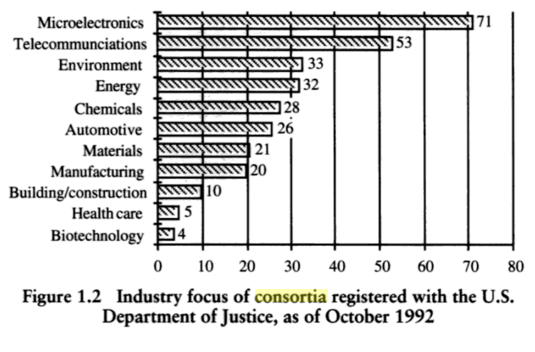

In the US, after the National Cooperative Research Act (1984), dozens of consortia appeared on the scene, bringing together a total of 3372 companies, 635 foreign members, 187 associations, institutes and councils, 218 universities, 33 federal agencies, and 84 state government agencies. Most of them (29%) were two-member organizations, and only a few (4%) had more than 75. Their activities were split in roughly thirds: pre-competitive research, noncompetitive research in industry trade associations, and joint research ventures.

Number of R&D consortia in the US

Number of R&D consortia in the US

These consortia include(d):

- The Electric Power Research Institute (EPRI, 1972), a nonprofit founded by the US electric utility industry. Its budget has grown from $200 in 1973 to $700 million in 1992, doing research in the field of electricity generation and transmission, including nuclear energy.

- The Gas Research Institute (GRI, 1976), founded by the American Gas Association of America as a nonprofit R&D trade organization. With a budget of $215 million, it subcontracts its research to universities, institutes, and private companies.

- The Microelectronics Center of North Carolina (MCNC, 1980), annually funded at $30 million (65% from the state of North Carolina). It has 70 members, 9 universities, and 1 research institution.

- The Semiconductor Research Corporation (SRC, 1982), created by 11 semiconductor manufacturers with a $7 million budget to enhace the US semiconductor industry's competitiveness. In 1993, they had a budget of $36 million, contributed by 24 members, 4 associates (including MCC and SEMATECH), 34 affiliate participants, and 7 US government agencies. 69% of the funding came from industry, 28% from SEMATECH, and 3% from the government. During the past decade they have funded over $200 million in semiconductor research.

- The Center for Advanced Television Studies (CATS, 1983), motivated by government but directed by industry, had 9 members, and it did research on HDTV.

- Smart House (1984), formed by 36 utility, appliance, and supply companies under the sponsorship of the National Association of Home Builders. It grew to have 116 members, including Apple, and Westinghouse. Its purpose was to conduct research on safer, more efficient home wiring to build a centrally controlled appliance system.

- The Plastics Recycling Foundation (PRF, 1985), investigates problems of solid waste management. Formed by 20 members, including Coca-Cola and Union Carbide.

- The National Center for Manufacturing Sciences (NCMS,1986), an non-profit receiving funding from industry, and state and federal governments. It had a budget of $10-15 million per year, and counted 160 members. The goal was to help firms become internationally competitive.

- The Semiconductor Manufacturing Technology Initiative (SEMATECH, 1987), an industry-government consortium to restore the US preeminence in semiconductor manufacturing. It had a funding of $180-200 million per year, with half coming from the government.

- The Consortium for Superconducting Electronics (1989), funded with $15 million (50% government), it had four members and conducted research on superconductive films.

- The Council of Consortia (1990), formed by the CEOs of basically all the previously mentioned US consortia, plus some other companies. To coordinate the coordination (heh) of research activities.

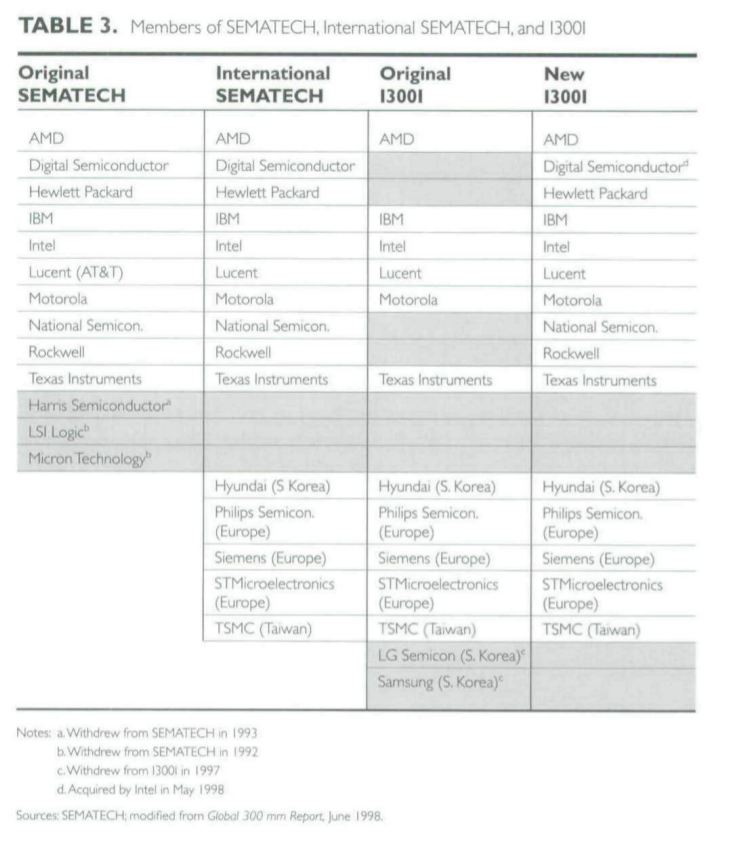

More recently, according to Ham et al. (1998)some other consortias formed are the International 300mm Initiative (I300I, 1995) in the US, and Semiconductor Leading Edge Technologies, Inc. (Selete, 1996) in Japan, both without government asistance. The paper points out some peculiarities of the semiconductor industry: While an individual product cycle is short, and technological advance is fast, the factories that manufacture semiconductors are expensive (>$2 billion), and are obsolete in 5-10 years. Tackling some research activities may be out of reach for an individual manufacturer, but possible for the industry as a whole. Interestingly, even after

Even after years had passed, there were still cultural differences in the organisations of both entities. I300I was more decentralised, and less ambitious (half the funding and staff) in scope than Selete. And unlike the consortia of the past, these two engaged in international cooperations, as the goal was now seen as more one of the industry, and less of a national one. The challenge this time was not to beat other nations, but to conquer the difficult process of making more advanced wafers. Even then, the actual membership of Selete and I300I were still mostly Japanese and American, respectively. In the case of the latest incarnation of SEMATECH, International SEMATECH, there were political hurdles that had to be overcome for the sharing effort to take place with non-American firms.

Cooperation in Wind Tunnels

A second example of cooperation, in a different industry:

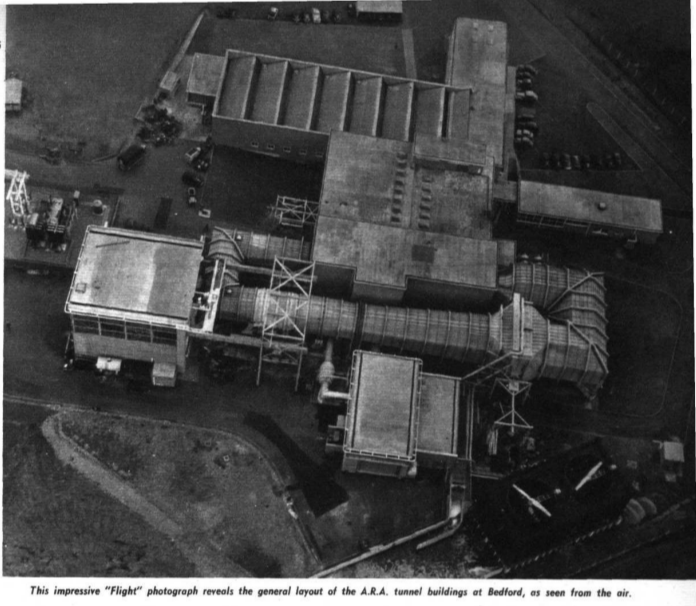

In Bedford, UK, there is a little known consortium, the Aircraft Research Association (ARA). Now it is part of the UK Aerodynamics Centre. In its website, there isn't much information about it, besides that it is a research association, and that is has four aerospace companies as members.

But some googling leads us to 'The ARA Tunnel', in the Flight Magazine (Vol 4. May 1956).

Back in the fifties, the UK industry was in the need of testing facilities. After WWII, the government had built some wind tunnels, but these were not suited to the specific requirements of industry. Some companies built their own tunnels, but they didn't have enough financial muscle to build and operate a large installation.

For some years, the Society of British Aircraft Constructors (SBAC), a trade association, organised talks to discuss the possibility of building such a facility.

This event ended up happening in 1952, and all major manufacturers participated (except for de Havilland, English Electric, and Short and Harland). They decided that the time allocation of the tunnels would be proportional to the funding provided to the project.

Altough right now it only counts four members, when it was originally opened, it had W.G. Armstrong Whitworth Aircraft, Armstrong Siddeley Motors, Blackburn and General Aircraft, Boulton Paul Aircraft, Bristol Aeroplane Co, Folland Aircraft, Handley Page, Gloster Aircraft, Hawker Aircraft, A.V. Roe and Co, Rolls-Royce, Vickers-Armstrong, Westland Aircraft, and Saunders-Roe.

The tunnel itself is capable of achieving Mach numbers between 0.6 and 1.3, and has a working section of 9x8 ft. It is capable of both regulating the temperature and density of the flow. (Gally, 2010)

By 1956, a supersonic 2x2 ft tunnel was built there, capable of achieving up to Mach 3.4.

In Southern California, some years before, in 1945, a similar tunnel was built: the Southern California Cooperative Wind Tunnel, counting Consolidated Vultee, Douglas, Lockheed, and North American among its members, managed by Caltech, and directed by Clark B. Millikan, professor of aeronautics, and future director of GALCIT. Remember that Caltech was the site of the Guggenheim-funded GALCIT. Millikan wanted to have this tunnel built, and he first sought government funding, but being turned down, he approached the industry, and managed to bring them together for the project (Albrecht & Crawford 1995)

This tunnel was 12x8 ft, and had the same features as the ARA one (Millikan, Smith & Bell, 1948) . It was closed in 1997.

How do they work

On paper, these consortia might strike some economistic-minded people as odd. Apparently, companies would have lots of incentives to try to appropriate other member's research, and little incentive to contribute themselves. But companies know this, and they also have a strong incentive to change their incentive structure, because they know sharing R&D costs is, sometimes, the best way to go.

In Majewski (2008), it is explained how consortia are structured. They also confirm that regarding the US Consortia, it was antitrust enforcement that difficulted the apparition of them: there were few before the NCRA, and lots after it.

Using k-means analysis, they try to distinguish several clusters of consortia, sorting them according to shared features:

- Group one, "Outsourced R&D" are consortia that outsource the majority of their R&D to a third party, splitting costs equally, and sharing profits resulting from the innovations.

- Group two, "Internal R&D" is composed of firms that do research for the joint project, and share intellectual property rights, to signal commitment not to sue the other part for patent infringement.

- Group three, "Spillover Control" have a provision in their contracts that no firm may license IP generated during the joint effort without the approval of the other firms. Costs tend to be equally shared, but not profits.

- Group four, "Learning via Personnel Exchange" heavily involve employee rotation across firm members, IP sharing, and the same restriction on licensing IP present in group 3. Altough there was also empoyee rotation in the other groups, this kind of focus on that was fairly rare (Only 6% of the sample studied)

- Group five, "Specialization" are firms that retain the rights to their own IP, do not share costs or profits, do not exchange pesonnel or IP, and do not restrict licensing of other's IP. Firms would chose this mode of cooperation to avoid opportunisn, and spillovers that think can't be avoided in other ways.

Most of the consortia are not focused on seeking technological complementarities, but just on reducing costs and duplications. Only a few (15%) allower scienists and engineers to move across diferent firms' facilities. A substantial amount (31%) split costs and risks evenly.

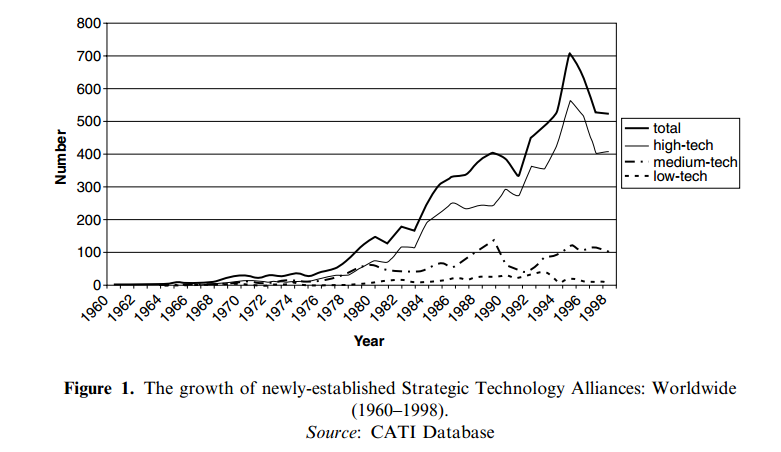

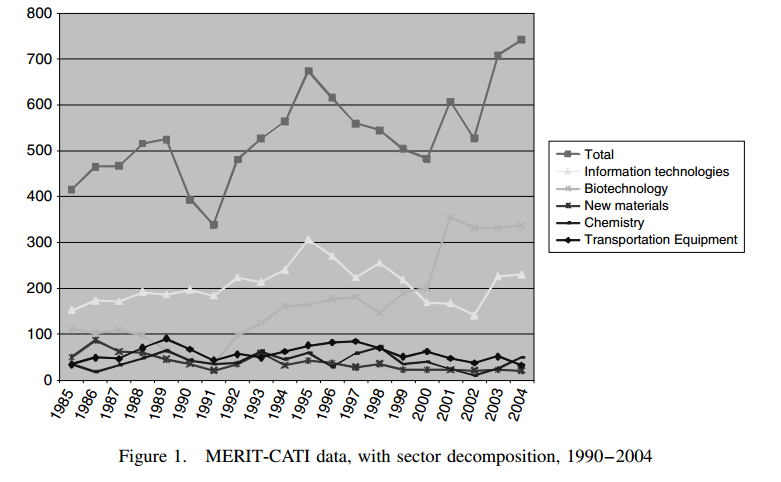

Majewski only considers a fraction of the consortia in the US. In contrast, Calaghirou et al. (2003) considers all of the consortia available in the MERIT-CATI database (which covers the entire world), and his findings are in agreement with Majewski's. Research consortia are not something of the past:

In moder recent times, the trend has recovered (Schilling 2008)

The process by which these agreements come to be is described by Faulkner et al. (2000).

The first step is to identify interdependencies. Different actors have to become aware of their situation within the market and society, and recognise that joint action can be in their individual interest. Broadly, the company comes to see itself as part of an industry, as an equal with other members. That added group identity can ease cooperation. Here States can play a role, as they are huge Schelling points: When companies look to a party to coordinate their efforts, they can rely on existing institutions to do so. In Japan, MITI played this role in the 80s, as did and does NACA and NASA for the US aerospace industry. Other factor that induces the formation of a shared identity is the identification of an outgroup: As we saw, many of the consortia in Japan and the US were formed because of fear of competition from an opposing country. The identities that developed were not just that of the 'semiconductor industry', but of the industries of each country. This also explains why foreigner companies were initially banned from some of these consortia, altough as time passed and companies noted that national pride could be detrimental to cooperation, more international consortia appeared.

The next step is to develop shared norms of problem solving. Different actors have diffeernt preferences for norms, and they will have to negotiate shared standards.

Then it comes a triggering action: someone with perceived legitimacy steps forward, takes leadership, and pushes the joint venture forward. The triggering actor has to be perceived as fair, as to guarantee that the venture will be mutually advantageous to all parts and capable of leadership. Governments and large corporations, or respected executives within industry are perceived to have these characteristics.

It is important for participants to be reminded that sustained, long-term cooperation will result in mutual gains. Actors that have a past record of succesful cooperation are likely to be accepted into future cooperative agreements. The consortia can be seen as a repeated, but finite, game (doing research together), within a repeated, indefinite game (sustaining credibility), in which the equilibria is to cooperate, if the agents are farsighted enough, and capable of recognising that it is in their interest to cooperate.

After this, it is a matter of designing how cooperation is going to take place (or adjusting the actor's future incentives to align them), to monitor how the joint venture is developing, and redesign it if necessary.

In Marinucci 2012 you can find a survey of the theoretical and empirical literature on R&D cooperation, but I think it doesn't add that much to what has been already presented here.

Bibliography

Aircraft Engineering and Aerospace Technology, Vol. 3 (1959) The New ARA Supersonic Wind Tunnel.

Albrecht, D., & Crawford, M. (1995). World War II and the American Dream: How Wartime Building Changed a Nation. MIT Press.

Allen, S. D., & Link, A. N. (2015). US research joint ventures with international partners. International Entrepreneurship and Management Journal, 11(1), 169-181.

Caloghirou, Y., Ioannides, S., & Vonortas, N. S. (2003). Research joint ventures. Journal of Economic Surveys, 17(4), 541-570.

Faulkner, D., & De Rond, M. (Eds.). (2000).Cooperative strategy: economic, business and organizational issues. Oxford: Oxford University Press.

Gally, Sid. (1 August 2010). Southern California Cooperative Wind Tunnel. Pasadena Star News. Pasadena, CA.

Gibson, D. V., & Rogers, E. M. (1994). R & D Collaboration on Trial: The Microelectronics and Computer Technology Corporation. Harvard Business Press.

Ham, R. M., Linden, G., & Appleyard, M. M. (1998). The evolving role of semiconductor consortia in the United States and Japan. California Management Review, 41, 137-155.

Majewski, S. E. (2004). How do consortia organize collaborative R&D? evidence from the national cooperative research act. Evidence from the National Cooperative Research Act (August 2004). Harvard Law and Economics Discussion Paper, (483).

Marinucci, M. (2012). A primer on R&D cooperation among firms. Bank of Italy Occasional Paper, (130).

Millikan, Clark B. (1945) The Southern California Cooperative Wind Tunnel. Engineering and Science. 8 (7): 3.

Millikan, C. B. (2012). High-speed testing in the Southern California cooperative wind tunnel. Journal of the Aeronautical Sciences (Institute of the Aeronautical Sciences), 15(2).

Schilling, M. A. (2008). Understanding the alliance data. Strategic Management Journal, 39 223-260.

Suller, V. P. (1992). Review of the status of synchrotron radiation storage rings. Daresbury Laboratory.

Citation

In academic work, please cite this essay as:

Ricón, José Luis, “R&D Consortia: Cooperating competitors”, Nintil (2016-01-28), available at https://nintil.com/rd-consortia-cooperating-competitors/.

Comments